POSITIVE MONEY

Recent Articles

Big Brother is

Watching You

Watching You

How to Escape the Federal Debt Trap

Comments by Ellen Brown May 6, 2025

Click Image to watch the FULL DOCUMENTARY

for Free

for Free

Chris Hedges

Mexico rejects Trump threats as Ottawa bows to US empire

By Ellen Brown / Original to ScheerPost

The U.S. national debt just passed $36 trillion, only four months after it passed $35 trillion and up $2 trillion for the year. Third quarter data is not yet available, but interest payments as a percent of tax receipts rose to 37.8% in the third quarter of 2024, the highest since 1996. That means interest is eating up over one-third of our tax revenues.

The U.S. national debt just passed $36 trillion, only four months after it passed $35 trillion and up $2 trillion for the year. Third quarter data is not yet available, but interest payments as a percent of tax receipts rose to 37.8% in the third quarter of 2024, the highest since 1996. That means interest is eating up over one-third of our tax revenues.

Total interest for the fiscal year hit $1.16 trillion, topping one trillion for the first time ever. That breaks down to $3 billion per day. For comparative purposes, an estimated $11 billion, or less than four days’ federal interest, would pay the median rent for all the homeless people in America for a year. The damage from Hurricane Helene in North Carolina alone is estimated at $53.6 billion, for which the state is expected to receive only $13.6 billion in federal support. The $40 billion funding gap is a sum we pay in less than two weeks in interest on the federal debt.

The current debt trajectory is clearly unsustainable, but what can be done about it? Raising taxes and trimming the budget can slow future growth of the debt, but they are unable to fix the underlying problem — a debt grown so massive that just the interest on it is crowding out expenditures on the public goods that are the primary purpose of government.

Borrowing Is Actually More Inflationary Than Printing

Borrowing Is Actually More Inflationary Than Printing

Several financial commentators have suggested that we would be better off if the Treasury issued the money for the budget outright, debt-free. Martin Armstrong, an economic forecaster with a background in computer science and commodities trading, contends that if we had just done that in the first place, the national debt would be only 40% of what it is today. In fact, he argues, debt today is the same as money, except that it comes with interest. Federal securities can be posted in the repo market as collateral for an equivalent in loans, and the collateral can be “rehypothecated” (re-used) several times over, creating new money that augments the money supply just as would happen if it were issued directly.

Chris Martenson, another economic researcher and trend forecaster, asked in a Nov. 21 podcast, “What great harm would happen if the Treasury just issued its own money directly and didn’t borrow it? … You’re still overspending, you still probably have inflation, but now you’re not paying interest on it.”

The argument for borrowing rather than printing is that the government is borrowing existing money, so it will not expand the money supply. That was true when money consisted of gold and silver coins, but it is not true today. In fact borrowing the money is now more inflationary, increasing the money supply more, than if it were just issued directly, due to the way the government borrows. It issues securities (bills, bonds and notes) that are bid on at auction by selected “primary dealers” (mostly very large banks).

Quoting from Investopedia:

Quoting from Investopedia:

Because most modern economies rely on fractional reserve banking, when primary dealers purchase government debt in the form of Treasury securities, they are able to increase their reserves and expand the money supply by lending it out. This is known as the money multiplier effect.

Thus, “the government increases cash reserves in the banking system,” and “the increase in reserves raises the money supply in the economy.” And because the debt is never repaid but just gets rolled over from year to year along with the interest due on it, the interest compounds, an increasing amount of debt-at-interest is generated, and the money supply and inflation go up.

U.S. Currency Should Be Issued by the U.S. Government

Well over 90% of the U.S. money supply today is issued not by the government but by private banks when they make loans. As Thomas Edison argued in 1921, “It is absurd to say that our country can issue $30 million in bonds and not $30 million in currency. Both are promises to pay, but one promise fattens the usurers and the other helps the people.”

The government could avoid increasing the debt by printing the money for its budget as President Lincoln did, as U.S. Notes or “Greenbacks.” Donald Trump acknowledged in 2016 that the government never has to default “because you print the money,” echoing Alan Greenspan, Warren Buffett and others. So writes Prof. Stephanie Kelton in a Dec. 2, 2024 blog. Alternatively, the Treasury could mint some trillion dollar coins. The Constitution gives Congress the power to coin money and regulate its value, and no limit is put on the value of the coins it creates. In legislation initiated in 1982, Congress chose to impose limits on the amounts and denominations of most coins, but a special provision allowed the platinum coin to be minted in any amount for commemorative purposes. Philip Diehl, former head of the U.S. Mint and co-author of the platinum coin law, confirmed that the coin would be legal tender:

In minting the $1 trillion platinum coin, the Treasury Secretary would be exercising authority which Congress has granted routinely for more than 220 years … under power expressly granted to Congress in the Constitution (Article 1, Section 8).

To prevent congressional overspending, a budget ceiling could be imposed – as it is now, although the terms would probably need to be revised.

Eliminating the Debt

Those maneuvers would prevent the federal debt from growing, but it still would not eliminate the trillion dollar interest tab on the existing $36 trillion debt. The only permanent solution is to eliminate the debt itself. In ancient Mesopotamia, when the king was the creditor, this was done with periodic debt jubilees — just cancel the debt. (See Michael Hudson, And Forgive Them Their Debts.) But that is not possible today because the creditors are private banks and private investors who have a contractual right to be paid, and the U.S. Constitution requires that the government pay its debts as and when due.

Another possibility is a financial transaction tax, which could replace both income and sales taxes while still generating enough to fund the government and pay off the debt. See Scott Smith, A Tale of Two Economies: A New Financial Operating System for the American Economy (2023) and my earlier article here. But that solution has been discussed for years without gaining traction in Congress.

Another alternative is to have the Federal Reserve buy the debt as it comes due. For the last few years, the Treasury has been issuing an estimated 30% of its debt as short-term bills rather than 10-year or 30-year bonds. As a result, in 2023 approximately 31% of the outstanding debt came due for renewal. As usual, it was just rolled over into new debt. But the nearly one-third coming due in FY2025 could be bought in the open market by the Federal Reserve, which is required to return its profits to the government after deducting its costs, making the debt virtually interest-free. Interest-free debt carried on the books and rolled over does not raise the federal deficit. If a third of the outstanding debt is too much to monetize in one year to avoid inflation, this maneuver could be spread out over a number of years.

Mandating that action by an “independent” Fed would require an amendment to the Federal Reserve Act, but Congress has the power to amend it and has done so several times over the years. The incoming Administration is proposing more radical moves than that, including eliminating the income tax, ending the Fed, auditing the Fed, or merging it with the Treasury.The federal interest tab nearly doubled after April 2022, when the Fed initiated “Quantitative Tightening.” It reduced its balance sheet by selling over $2 trillion in federal securities into the economy, reducing the money supply, and by hiking the federal funds rate to as high as 5.5%. Arguably the Fed has overtightened and needs to reverse that trend by buying federal securities, injecting new money into the economy.

How to Avoid Hyperinflation

Alarmed economists contend that a Weimar-style hyperinflation is the inevitable outcome of government-issued money. But as Michael Hudson points out, “Every hyperinflation in history has been caused by foreign debt service collapsing the exchange rate. The problem almost always has resulted from wartime foreign currency strains, not domestic spending.”

Issuing the money directly will not inflate prices if the funds are used to increase the domestic supply of goods and services. Supply and demand will then go up together, keeping prices stable. This has been illustrated historically, perhaps most dramatically in China. The People’s Bank of China manages the money supply by a variety of means including just printing currency. In 28 years, from 1996 to 2024, China’s money supply (M2) grew by 52 times or 5,200%, yet hyperinflation did not result. Prices remained stable because the funds went into increasing GDP, which went up along with the money supply.

Price inflation during the Covid crisis has been blamed on the Fed monetizing Congressional fiscal payments to consumers and businesses, increasing demand (the circulating money supply) without increasing supply (goods and services). But the San Francisco Fed concluded that the surge in global shipping and transportation costs due to COVID, along with delivery delays and backlogs, were a greater contributor than this fiscal stimulus to the runup of headline inflation in 2021 and 2022. The supply of goods could have been increased – producers could have increased production to respond to the increase in demand — were it not for the shutdown of more than 700,000 productive businesses labeled “non-essential,” resulting in the loss of three million jobs.

Swapping Debt for Productive Equity

Money printing is not inflationary if the money is issued for productive purposes, raising GDP in lockstep; but how can we be sure that the new money will be used productively? Today the banks and other large institutions that first receive any newly-issued money are more likely to invest it speculatively, driving up the price of existing assets (homes, stocks, etc.) without creating new goods and services.

Economic blogger Martin Armstrong observes that one solution pursued by debt-ridden countries is to swap the debt for equity in productive assets. This has been done by Mexico, Poland, Croatia, the Czech Republic, Hungary, and the United States itself. It was the solution of Treasury Secretary Alexander Hamilton in dealing with the overwhelming debt of the First U.S. Congress. State and federal debt was swapped along with gold for shares in the First U.S. Bank, paying a 6% dividend. The Bank then issued U.S. currency at up to 10 times this capital base, on the fractional reserve model still used by banks today. Both the First and the Second U.S. Banks were designed to support manufacturing and production, according to Hamilton’s Report on Public Credit.

Following the Hamiltonian model is H.R. 4052, the National Infrastructure Bank Act of 2023 (NIB) now pending in Congress. The NIB proposal is to swap privately-held federal securities (Treasury bonds) for non-voting preferred stock in the bank. Interest on the bonds would continue to go to the investors, along with a 2% stock dividend. That would not eliminate the debt or the interest, but if the Federal Reserve were to buy federal securities on the open market and swap them for NIB stock, the securities would essentially remain interest-free, since again the Fed is required to return its profits to the Treasury after deducting its costs.

Lending Directly to Productive Businesses

Another possibility for using newly issued money to increase the supply of goods and services is for the Federal Reserve to make loans directly to productive businesses. That was actually the intent of the original Federal Reserve Act. Section 13 of the Act allows Federal Reserve Banks to discount notes, drafts, and bills of exchange arising out of actual commercial transactions, such as those issued for agricultural, industrial or commercial purposes – in other words, lending directly for production and development. “Discounting commercial paper” is a process by which short-term loans are provided to financial institutions using commercial paper as collateral. (Commercial paper is unsecured short-term debt, usually issued at a discount, used to cover payroll, inventory and other short-term liabilities. The “discount” represents the interest to the lender.)

According to Prof. Carl Walsh, writing of the Federal Reserve Act in The Federal Reserve Bank of San Francisco Newsletter in 1991:

According to Prof. Carl Walsh, writing of the Federal Reserve Act in The Federal Reserve Bank of San Francisco Newsletter in 1991:

“The preamble sets out very clearly that one purpose of the Federal Reserve Act was to afford a means of discounting commercial loans. In its report on the proposed bill, the House Banking and Currency Committee viewed a fundamental objective of the bill to be the “creation of a joint mechanism for the extension of credit to banks which possess sound assets and which desire to liquidate them for the purpose of meeting legitimate commercial, agricultural, and industrial demands on the part of their clientele.”

McKinley or Lincoln? Tariffs vs. Greenbacks

Posted on April 8, 2025 by Ellen Brown

President Trump has repeatedly expressed his admiration for Republican President William McKinley, highlighting his use of tariffs as a model for economic policy. But critics say Trump’s tariffs, which are intended to protect U.S. interests, have instead fueled a stock market nosedive, provoked tit-for-tat tariffs from key partners, risk a broader trade withdrawal, and could increase the federal debt by reducing GDP and tax income.

Posted on April 8, 2025 by Ellen Brown

President Trump has repeatedly expressed his admiration for Republican President William McKinley, highlighting his use of tariffs as a model for economic policy. But critics say Trump’s tariffs, which are intended to protect U.S. interests, have instead fueled a stock market nosedive, provoked tit-for-tat tariffs from key partners, risk a broader trade withdrawal, and could increase the federal debt by reducing GDP and tax income.

The federal debt has reached $36.2 trillion, the annual interest on it is $1.2 trillion, and the projected 2025 budget deficit is $1.9 trillion – meaning $1.9 trillion will be added to the debt this year. It’s an unsustainable debt bubble doomed to pop on its present trajectory.

The goal of Elon Musk’s DOGE (Department of Government Efficiency) is to reduce the deficit by reducing budget expenditures. But Musk now acknowledges that the DOGE team’s efforts will probably cut expenses by only $1 trillion, not the $2 trillion originally projected. That will leave a nearly $1 trillion deficit that will have to be covered by more borrowing, and the debt tsunami will continue to grow.

Rather than modeling the economy on McKinley, President Trump might do well to model it on our first Republican president, Abraham Lincoln, whose debt-free Greenbacks saved the country from a crippling war debt to British-backed bankers, and whose policies laid the foundation for national economic resilience in the coming decades. Just “printing the money” can be and has been done sustainably, by directing the new funds into generating new GDP; and there are compelling historical examples of that approach. In fact, it may be our only way out of the debt crisis. But first a look at the tariff issue.

Continue reading →

Filed under: Ellen Brown Articles/Commentary | Tagged: economics, economy, Ellen Brown, FINANCE, Greenbacks, Inflation, LINCOLN, McKinley, money, NATIONAL INFRASTRUCTURE BANK, politics, public banking | 1 Comment »

‘Quantitative Easing with Chinese Characteristics’: How to Fund an Economic Miracle

Posted on February 11, 2025 by Ellen Brown

China went from one of the poorest countries in the world to global economic powerhouse in a mere four decades. Currently featured in the news is DeepSeek, the free, open source A.I. built by innovative Chinese entrepreneurs which just pricked the massive U.S. A.I. bubble.

Even more impressive, however, is the infrastructure China has built, including 26,000 miles of high speed rail, the world’s largest hydroelectric power station, the longest sea-crossing bridge in the world, 100,000 miles of expressway, the world’s first commercial magnetic levitation train, the world’s largest urban metro network, seven of the world’s 10 busiest ports, and solar and wind power generation accounting for over 35% of global renewable energy capacity. Topping the list is the Belt and Road Initiative, an infrastructure development program involving 140 countries, through which China has invested in ports, railways, highways and energy projects worldwide.

All that takes money. Where did it come from? Numerous funding sources are named in mainstream references, but the one explored here is a rarely mentioned form of quantitative easing — the central bank just “prints the money.” (That’s the term often used, though printing presses aren’t necessarily involved.)

Continue reading →

Filed under: Ellen Brown Articles/Commentary | Tagged: china, economy, Ellen Brown, Inflation, infrastructure, infrastructure banks, public banking, quantitative easing | 14 Comments »

Beating Wall Street at Its Own Game — The Bank of North Dakota Model

Posted on January 15, 2025 by Ellen Brown

North Dakota is staunchly conservative, having voted Republican in every presidential election since Lyndon Johnson in 1964. So how is it that the state boasts the only state-owned bank in the nation? Has it secretly gone socialist?

No. The Bank of North Dakota (BND) operates on the same principles as any capitalist bank, except that its profits and benefits serve the North Dakota public rather than private investors and executives. The BND provides a unique, innovative model, in which public ownership is leveraged to enhance the workings of the private sector. It invests in and supports private enterprise — local businesses, agriculture, and economic development – the core activities of a capitalist system where private property and enterprise are central. Across the country, small businesses are now failing at increasingly high rates, but that’s not true in North Dakota, which was rated by Forbes Magazine the best state in which to start a business in 2024.

The BND was founded in 1919, when North Dakota farmers rose up against the powerful out-of-state banking-railroad-granary cartel that was unfairly foreclosing on their farms. They formed the Non-Partisan League, won an election, and founded the state’s own bank and granary, both of which are still active today.

The BND operates within the private financial market, working alongside private banks rather than replacing them. It provides loans and other banking services, primarily to other banks, local governments, and state agencies, which then lend to or invest in private sector enterprises. It operates with a profit motive, with profits either retained as capital to increase the bank’s loan capacity or returned to the state’s general fund, supporting public projects, education, and infrastructure.

According to the BND website, more than $1 billion had been transferred to the state’s general fund and special programs through 2018, most of it in the previous decade. That is a substantial sum for a state with a population that is only about one-fifteenth the size of Los Angeles County.

The BND actually beats private banks at their own game, generating a larger return on equity (ROE) for its public citizen-owners than even the largest Wall Street banks return to their private investors.

Continue reading →

Filed under: Ellen Brown Articles/Commentary | Tagged: bail-in, Bank of North Dakota, bank runs, capitalism, derivatives, disaster relief, economics, economy, Ellen Brown, FINANCE, JPMorganChase, money, news, public banking | 4 Comments »

How to Escape the Federal Debt Trap

Posted on December 10, 2024 by Ellen Brown

The U.S. national debt just passed $36 trillion, only four months after it passed $35 trillion and up $2 trillion for the year. Third quarter data is not yet available, but interest payments as a percent of tax receipts rose to 37.8% in the third quarter of 2024, the highest since 1996. That means interest is eating up over one-third of our tax revenues.

Total interest for the fiscal year hit $1.16 trillion, topping one trillion for the first time ever. That breaks down to $3 billion per day. For comparative purposes, an estimated $11 billion, or less than four days’ federal interest, would pay the median rent for all the homeless people in America for a year. The damage from Hurricane Helene in North Carolina alone is estimated at $53.6 billion, for which the state is expected to receive only $13.6 billion in federal support. The $40 billion funding gap is a sum we pay in less than two weeks in interest on the federal debt.

The current debt trajectory is clearly unsustainable, but what can be done about it? Raising taxes and trimming the budget can slow future growth of the debt, but they are unable to fix the underlying problem — a debt grown so massive that just the interest on it is crowding out expenditures on the public goods that are the primary purpose of government.

Borrowing Is Actually More Inflationary Than Printing

Filed under: Ellen Brown Articles/Commentary | Tagged: Ellen Brown, federal debt, Federal Reserve, Greenbacks, Inflation, public banking, quantitative easing | 5 Comments »

Our Fragile Infrastructure: Lessons From Hurricane Helene

Posted on November 5, 2024 by Ellen Brown

Buncombe County North Carolina – damage after Hurricane Helene floods. NCDOTcommunications, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons

Asheville, North Carolina, is known for its historic architecture, vibrant arts scene and as a gateway to the Blue Ridge Mountains. It was a favorite escape for “climate migrants” moving from California, Arizona, and other climate-challenged vicinities, until a “500 year flood” ravaged the city this fall.

Hurricane Helene was a wakeup call not just for stricken North Carolina residents but for people across the country following their tragic stories in the media and in the podcasts now favored by young voters for news. “Preppers” well equipped with supplies watched in helpless disbelief as homes washed away in a wall of water and mud, taking emergency supplies in the storm. Streets turned into rivers, and many businesses and homes suffered extensive water damage if they were not lost altogether.

The raging floods were triggered by unprecedented rainfall and winds, but a network of fragile dams also played a role. On Sept 27, when the floods hit, evacuation orders were issued to residents near a number of critical dams due to their reported “imminent failure” or “catastrophic collapse.” Flood waters were overtopping the dams to the point that in some cases the top of the dam structure could not be seen.

The dams did not collapse, but to avoid that catastrophe, floodgates and spillways had to be opened, releasing huge amounts of water over a number of days. Spokesmen said the dams had “performed as designed,” but they were designed for an earlier era with more stable, predictable climates and no population buildup below the dams.

Continue reading →

Filed under: Ellen Brown Articles/Commentary | Tagged: Bank of North Dakota, dams, Ellen Brown, FEMA, floods, Hurricane Helene, infrastructure, NATIONAL INFRASTRUCTURE BANK, public banking | 2 Comments »

The Florida State Sunshine Bank: How a State-Owned Bank Can Protect Free Speech

Posted on September 14, 2024 by Ellen Brown

Fifteen years have passed since the Occupy Wall Street movement focused attention on the inequities and hazards of large Wall Street banks, particularly those risky banks with trillions of dollars in derivatives on their books. “Move your money” was the obvious response, but what could local governments do? Their bank accounts were too large for local banks to handle.

Thus was the public banking movement born. The impressive potential of government-owned banks was demonstrated by the century-old Bank of North Dakota (BND), currently the nation’s only state-owned bank. In the last fifteen years, over 100 bills and resolutions for local U.S. government-owned banks have been filed based on the BND model. But while promising bills are still pending, so far the allure of saving money, stimulating the local economy, banking the underbanked and avoiding a derivative crisis has been insufficient to motivate local legislators to pass bills opposed by their Wall Street patrons. State legislators have acknowledged potential benefits, but they have generally not been ready to rock the boat when the situation did not appear to be urgent.

Now, however, Florida Chief Financial Officer Jimmy Patronis has come up with an urgent reason for a state to own its own bank – to avoid bank regulations designed to achieve social or political ends that state officials believe are inappropriate or go too far, including “debanking” vocal opponents of federal policy. The concerns are Constitutional, testing the First Amendment guarantees of free speech, freedom of the press and freedom of religion, and the 10th Amendment right of states and citizens to self-govern in matters not specifically delegated in the Constitution to central government oversight.

Continue reading →

Filed under: Ellen Brown Articles/Commentary | Tagged: Bank of North Dakota, debanking, economy, Florida economy, freedom of speech, public banking | 2 Comments »

How Unelected Regulators Unleashed the Derivatives Monster – and How It Might Be Tamed

Posted on August 4, 2024 by Ellen Brown

“It was not the highly visible acts of Congress but the seemingly mundane and often nontransparent actions of regulatory agencies that empowered the great transformation of the U.S. commercial banks from traditionally conservative deposit-taking and lending businesses into providers of wholesale financial risk management and intermediation services.”

— Professor Saule Omarova, “The Quiet Metamorphosis, How Derivatives Changed the Business of Banking” University of Miami Law Review, 2009

While the world is absorbed in the U.S. election drama, the derivatives time bomb continues to tick menacingly backstage. No one knows the actual size of the derivatives market, since a major portion of it is traded over-the-counter, hidden in off-balance-sheet special purpose vehicles. However, when Warren Buffet famously labeled derivatives “financial weapons of mass destruction” in 2002, its “notional value” was estimated at $56 trillion. Twenty years later, the Bank for International Settlements estimated that value at $610 trillion. And financial commentators have put it as high as $2.3 quadrillion or even $3.7 quadrillion, far exceeding global GDP, which was about $100 trillion in 2022. A quadrillion is 1,000 trillion.

Most of this casino is run through the same banks that hold our deposits for safekeeping. Derivatives are sold as “insurance” against risk, but they actually add a heavy layer of risk because the market is so interconnected that any failure can have a domino effect. Most of the banks involved are also designated “too big to fail,” which means we the people will be bailing them out if they do fail.

The Supreme Court Takes on the Administrative State

Posted on July 15, 2024 by Ellen Brown

In a highly controversial decision, the Supreme Court on June 28 reversed a 40-year old ruling, reclaiming the Court’s role as interpreter of statutory law as it applies to a massive body of regulations imposed by federal agencies in such areas as the environment, workplace safety, public health and more.

The Court’s 6-3 conservative majority overturned a 1984 ruling, also issued by that Court’s conservative majority, that granted authority to a federal agency if a Congressional statute involving that agency was ambiguous or incomplete. It left the interpretation of the law to the agency rather than the courts.

This principle blocked individuals and businesses from suing agencies in court for damages incurred when the agencies exceeded their Congressional mandates.

“Chevron deference,” the name given the 1984 decision due to the litigation involving that company, has been grounds for upholding thousands of regulations by a host of federal agencies over the last four decades. Opinions by commentators on its reversal range from “an epic disaster, … one of the worst Supreme Court rulings … another huge gift to special interests and corporations,” to “a victory for the common man” and “an important win for accountability and predictability at a time when agencies are unleashing a tsunami of regulation — in many cases clearly exceeding their statutory authority ….”

Why Does the Government Borrow When It Can Print?

Posted on June 19, 2024 by Ellen Brown

In the first seven months of Fiscal Year (FY) 2024, net interest (payments minus income) on the federal debt reached $514 billion, exceeding spending on both national defense ($498 billion) and Medicare ($465 billion). The interest tab also exceeded all the money spent on veterans, education, and transportation combined. Spending on interest is now the second largest line item in the federal budget after Social Security and the fastest growing part of the budget, on track to reach $870 billion by the end of 2024.

According to the Congressional Budget Office, the federal budget deficit was $857 billion in the first seven months of fiscal year 2024. In effect, the government is borrowing at interest to pay the interest on its debt, compounding the debt. For the lender, it’s called “the miracle of compound interest” – interest on interest compounds exponentially. But for the debtor, it’s a curse, compounding like a cancer to the point of devouring assets while still growing the debt. As Daniel Amerman, a chartered financial analyst, writes in an article titled “Could A Compound Interest Wildfire Threaten U.S. Solvency?”:

Tackling California’s Budget Crisis: Raise Taxes, Cut Programs, or Form a Bank?

Posted on May 8, 2024 by Ellen Brown

In 2022, the state of California celebrated a record budget surplus of $97.5 billion. Two years later, according to the Legislative Analyst’s Office, this surplus has plummeted to a record budget deficit of $73 billion. Balancing the budget will be challenging. Unlike the federal government, the state cannot just drive up debt and roll it over year after year. The California Balanced Budget Act, passed in 2004, requires the state legislature to pass a balanced budget every year.

The usual solutions are to cut programs or raise taxes, but both approaches are facing an uphill battle. Raising taxes would require a two-thirds vote of the legislature, which would be very challenging, and worthy public programs are in danger of getting axed, including homelessness prevention and funding for low-income housing.

A third possibility might be to increase the income tax base and state income by stimulating the economy with a state-owned depository bank. The state-owned Bank of North Dakota, which has raised record profits for its state, is a stellar example. In a review of states with the healthiest budgets based on data from the PEW Charitable Trusts, U.S. News & World Report puts North Dakota at No. 1 in Budget Balancing and #1 in Short-term Fiscal Stability.

California has an Infrastructure and Development Bank, which is already capitalized and has an established track record of prudent and productive lending, but it is not a depository bank and its reach is small. Transforming it into a depository bank would be fairly uncomplicated and could substantially increase its reach.

But first a look at what happened to the state’s copious revenues.

By the Dawn’s Early Light: On the Fall of the Francis Scott Key Bridge

Posted on April 7, 2024 by Ellen Brown

The Baltimore bridge that collapsed on March 26th was named for Francis Scott Key, who wrote the lyrics to the American national anthem “The Star-Spangled Banner” in 1814. His inspiration was the British bombardment of Fort McHenry in the critical port of Baltimore during the War of 1812. The British had just burned the U.S. Capitol and the White House and had set their sights on the Baltimore port, with the guns from hundreds of British ships trained on shelling the American flag. If the flag were taken down, they would know the Americans had surrendered, and the British agreed the shelling would stop. But in the dawn’s early light, the flag still waved, held up by patriots who replaced soldiers who had fallen before them. Francis Scott Key observed all this from a British ship on which he had been allowed on board to negotiate a prisoner release. It is a quite moving story, dramatized here.

What the dawn’s early light brought on March 26, 2024, by contrast, were shocking news videos of the Francis Scott Key Bridge collapsing when the Singapore-owned cargo ship Dali slammed into it. It was “like something out of an action movie,” said Baltimore Mayor Brandon Scott. Several commentators are calling it a “black swan” event that will have catastrophic effects on global supply chains. Interestingly, the War of 1812 was also about disruptions to U.S. trade with foreign nations, in that case by blockade by the British navy. But more on that, and on how our forebears turned dependence on foreign manufacturers into economic independence, after a look at what went amiss with the Dali and the bridge.

The Public Bank That Wasn’t: New Jersey’s Excursion into Public Banking

Posted on March 9, 2024 by Ellen Brown

In 2017, Phil Murphy, a former Goldman Sachs executive, made the establishment of a public, state-owned bank a centerpiece issue during his run for New Jersey governor. He regularly championed public banking in speeches, town halls and campaign commercials. He won the race, and the nation’s second state-owned bank following the stellar model of the Bank of North Dakota (BND) appeared to be in view.

Due to the priority of other economic-policy goals, the initiative was largely kept on the back burner until November 2019. Then, in an article titled “Murphy Takes First Key Step Toward Establishing a Public Bank,” the New Jersey Spotlight announced:

Gov. Phil Murphy is planning to sign an executive order Wednesday [Nov. 13] that will create a 14-member “implementation board” to advance his goal of establishing a public bank in New Jersey.

The basic premise of such an institution is to hold the millions of dollars in taxpayer deposits that are normally kept in commercial banks and leverage them instead to serve some sort of public purpose. … [Emphasis added.]

North Dakota currently is the only state that operates a public bank wholly backed by the deposit of government funds. [Emphasis added.] Founded a century ago to help insulate farmers from predatory out-of-state lenders, the Bank of North Dakota offers residents, businesses and students low-cost services like checking accounts and loans. It has also been used to advance projects that boost infrastructure and economic development, and has even produced revenue for the state budget’s general fund, according to the bank’s promotional materials, thanks to lending operations that regularly turn a profit.

Defusing the Derivatives Time Bomb: Some Proposed Solutions

Posted on February 16, 2024 by Ellen Brown

The “protected class” is granted “safe harbor” only because their bets are so risky that to let them fail could crash the economy. But why let them bet at all?

This is a sequel to a Jan. 15 article titled “Casino Capitalism and the Derivatives Market: Time for Another ‘Lehman Moment’?”, discussing the threat of a 2024 “black swan” event that could pop the derivatives bubble. That bubble is now over ten times the GDP of the world and is so interconnected and fragile that an unanticipated crisis could trigger the collapse not just of the bubble but of the economy. To avoid that result, in the event of the bankruptcy of a major financial institution, derivative claimants are put first in line to grab the assets — not just the deposits of customers but their stocks and bonds. This is made possible by the Uniform Commercial Code, under which all assets held by brokers, banks and “central clearing parties” have been “dematerialized” into fungible pools and are held in “street name.”

This article will consider several proposed alternatives for diffusing what Warren Buffett called a time bomb waiting to go off. That sort of bomb just detonated in the Chinese stock market, contributing to its fall; and the result could be much worse in the U.S., where the stock market plays a much larger role in the economy.

Casino Capitalism and the Derivatives Market:

Time for Another ‘Lehman Moment’?

Time for Another ‘Lehman Moment’?

Posted on January 17, 2024 by Ellen Brown

Reading the tea leaves for the 2024 economy is challenging. On January 5th, Treasury Secretary Janet Yellen said we have achieved a “soft landing,” with wages rising faster than prices in 2023. But critics are questioning the official figures, and prices are still high. Surveys show that consumers remain apprehensive.

There are other concerns. On Dec. 24, 2023, Catherine Herridge, a senior investigative correspondent for CBS News covering national security and intelligence, said on “Face the Nation,” “I just feel a lot of concern that 2024 may be the year of a black swan event. This is a national security event with high impact that’s very hard to predict.”

What sort of event she didn’t say, but speculations have included a major cyberattack; a banking crisis due to a wave of defaults from high interest rates, particularly in commercial real estate; an oil embargo due to war; or a civil war. Any major black swan could prick the massive derivatives bubble, which the Bank for International Settlements put at over one quadrillion (1,000 trillion) dollars as far back as 2008. With global GDP at only $100 trillion, there is not enough money in the world to satisfy all these derivative claims. A derivative crisis helped trigger the 2008 banking collapse, and that could happen again.

The dangers of derivatives have been known for decades. Warren Buffett wrote in 2002 that they were “financial weapons of mass destruction.” James Rickards wrote in U.S. News & World Report in 2012 that they should be banned. Yet Congress has not acted. This article looks at the current derivative threat, and at what might motivate our politicians to defuse it.

Three Presidents Who Made Thanksgiving a National Holiday —

And What They Were Thankful For

And What They Were Thankful For

Posted on November 24, 2023 by Ellen Brown

Three U.S. presidents were instrumental in establishing Thanksgiving as a regular national event. On October 3, 1789, George Washington declared the first federal Thanksgiving holiday. In 1863, Abraham Lincoln made it an annual federal holiday. And in 1941, Franklin Roosevelt signed a bill setting the date at the fourth Thursday of every November. All three presidents were giving thanks for bringing the country through a major financial crisis related to war, and they all achieved this feat through what Sen. Henry Clay called the “American system” of banking and finance – sovereign or government-issued money and credit.

For Washington, the challenge was freeing the American colonies from the imperial rule of Britain, then the world’s leading military power, when the new government lacked a source of funding. Lincoln faced a similar challenge, leading the Northern states in a civil war while lacking a national bank or national currency to fund it. For Roosevelt, the challenge was bringing the country through the Great Depression and World War II, when 9,000 banks had gone bankrupt at the beginning of his first term and the country was again without a source of credit.

In 1796, after 20 years of public service, George Washington warned in his farewell address to “cherish public credit” and avoid “accumulation of debt,” and to “avoid foreign entanglements” (“steer clear of permanent alliances with any portion of the foreign world”). He would no doubt be alarmed to see where we are 227 years later. We have a federal debt of $33.7 trillion, bearing an interest tab of nearly $1 trillion annually — over one-third of personal tax receipts. And we have a military budget from “foreign entanglements” that is also approaching one trillion dollars, devouring more than half the annual discretionary budget. Meanwhile, according to the American Society of Civil Engineers, the country is in serious need of infrastructure funding, tallied at $3 trillion or more; but our debt-strapped Congress has no appetite or capacity for further infrastructure outlays.

However, Washington, Lincoln and Roosevelt faced financial challenges that were equally daunting in their day; and the country came through them and continued to thrive, using a funding device that Benjamin Franklin described as “a mystery even to the politicians.”

“The Great Taking”: How They Can Own It All

Posted on October 3, 2023 by Ellen Brown

“’You’ll own nothing and be happy’? David Webb has gone through the 50-year history of all the legal constructs that have been put in place to technically enable that to happen.” [Oct 2 interview titled “The Great Taking: Who Really Owns Your Assets?”]

The derivatives bubble has been estimated to exceed one quadrillion dollars (a quadrillion is 1,000 trillion). The entire GDP of the world is estimated at $105 trillion, or 10% of one quadrillion; and the collective wealth of the world is an estimated $360 trillion. Clearly, there is not enough collateral anywhere to satisfy all the derivative claims. The majority of derivatives now involve interest rate swaps, and interest rates have shot up. The bubble looks ready to pop.

Who were the intrepid counterparties signing up to take the other side of these risky derivative bets? Initially, it seems, they were banks –led by four mega-banks, JP Morgan Chase, Citibank, Goldman Sachs and Bank of America. But according to a 2023 book called The Great Taking by veteran hedge fund manager David Rogers Webb, counterparty risk on all of these bets is ultimately assumed by an entity called the Depository Trust & Clearing Corporation (DTCC), through its nominee Cede & Co. (See also Greg Morse, “Who Owns America? Cede & DTCC,” and A. Freed, “Who Really Owns Your Money? Part I, The DTCC”). Cede & Co. is now the owner of record of all of our stocks, bonds, digitized securities, mortgages, and more; and it is seriously under-capitalized, holding capital of only $3.5 billion, clearly not enough to satisfy all the potential derivative claims. Webb thinks this is intentional.

What happens if the DTCC goes bankrupt? Under The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) of 2005, derivatives have “super-priority” in bankruptcy. (The BAPCPA actually protects the banks and derivative claimants rather than consumers; it was the same act that eliminated bankruptcy protection for students.) Derivative claimants don’t even need to go through the bankruptcy court but can simply nab the collateral from the bankrupt estate, leaving nothing for the other secured creditors (including state and local governments) or the banks’ unsecured creditors (including us, the depositors). And in this case the “bankrupt estate” – the holdings of the DTCC/Cede & Co. – includes all of our stocks, bonds, digitized securities, mortgages, and more.

More Banks to Fail? Not in North Dakota

Posted on September 1, 2023 by Ellen Brown

U.S. banks are again in the crosshairs. Standard and Poor’s has downgraded five new middle-tier banks and put three others on negative outlook. This follows sweeping downgrades earlier in August by Moody’s, which cut credit ratings on 10 banks and placed four of the 15 largest U.S. banks on review for possible downgrade. As with the banks going into receivership earlier this year, concerns include interest rate risk due to unrealized losses from long-term securities.

Meanwhile, the U.S. government itself has been downgraded by Fitch Ratings, which questions the government’s ability to finance its nearly $33 trillion federal debt. Just the interest on the debt is approaching $1 trillion annually — one third of the government’s federal income tax receipts — while the military budget is closing in on another $1 trillion, devouring over half the discretionary federal budget. That leaves virtually none to cover the nearly $6 trillion that, according to the American Society of Civil Engineers, is needed to repair America’s broken infrastructure, among other neglected service needs.

War By Other Means: Short Selling JPMorgan

Posted on August 10, 2023 by Ellen Brown

When the FDIC put Silicon Valley Bank (SVB) and Signature Bank into receivership in March, a study reported on the Social Science Research Network found that nearly 200 midsized U.S. banks were similarly vulnerable to bank runs. First Republic Bank went into receivership in May, but the feared contagion of runs did not otherwise occur. Why not? As was said of Lehman Brothers fifteen years earlier, the targeted banks did not fall; they were pushed, or so it seems. One blogger shows how even JPMorgan Chase, the country’s largest bank, could be pushed — not perhaps by local short-sellers, but by China. And that is another good reason not to provoke the Chinese Dragon into “war by other means.”

The Federal Debt Trap: Issues and Possible Solutions

Posted on July 14, 2023 by Ellen Brown

First posted on ScheerPost.

“Rather than collecting taxes from the wealthy,” wrote the New York Times Editorial Board in a July 7 opinion piece, “the government is paying the wealthy to borrow their money.”

Titled “America Is Living on Borrowed Money,” the editorial observes that over the next decade, according to the Congressional Budget Office (CBO), annual federal budget deficits will average around $2 trillion per year. By 2029, just the interest on the debt is projected to exceed the national defense budget, which currently eats up over half of the federal discretionary budget. In 2029, net interest on the debt is projected to total $1.07 trillion, while defense spending is projected at $1.04 trillion. By 2033, says the CBO, interest payments will reach a sum equal to 3.6 percent of the nation’s economic output.

Another Look at the Financial Transactions Tax

That Could Eliminate Need for All Others

That Could Eliminate Need for All Others

Posted on June 2, 2023 by Ellen Brown

A small financial transactions tax could correct a number of maladies in our economic system, from the federal debt crisis to the widening wealth divide to the rampant financialization of the economy, while eliminating taxes on income and sales.

The debt ceiling crisis has again brought into focus the perennial gap between what the government spends and what it accumulates in taxes, and the virtual impossibility of closing that gap by increasing taxes or negotiating cuts in the budget.

In a 2023 book titled A Tale of Two Economies: A New Financial Operating System for the American Economy, Wall Street veteran Scott Smith shows that we would need to tax everyone at a rate of 40%, without deductions, to balance the budgets of our federal and local governments – an obvious nonstarter. The problem, he argues, is that we are taxing the wrong things – income and physical sales. In fact, we have two economies – the material economy in which goods and services are bought and sold, and the monetary economy involving the trading of financial assets (stocks, bonds, currencies, etc.) – basically “money making money” without producing new goods or services.

Drawing on data from the Bank for International Settlements and the Federal Reserve, Smith shows that the monetary economy is hundreds of times larger than the physical economy. The budget gap could be closed by imposing a tax of a mere 0.1% on financial transactions, while eliminating not just income taxes but every other tax we pay today. For a financial transactions tax (FTT) of 0.25%, we could fund benefits we cannot afford today that would stimulate growth in the real economy, including not just infrastructure and development but free college, a universal basic income, and free healthcare for all. Smith contends we could even pay off the national debt in ten years or less with a 0.25% FTT.

A radical change in the tax structure may seem unlikely any time soon, due to the inertia of Congress and the overweening power of the financial industry. But as economist Michael Hudson and other commentators observe, the U.S. has reached its limits to growth without some sort of debt write down. Federal interest expense as a percent of tax revenues spiked to 32.9% in the first quarter of 2023, and it will spike further as old securities at lower interest rates mature and are replaced with new ones at much higher interest. A financial reset is not only necessary but may be imminent. Promising proposals like Smith’s can lead the way to a much-needed shift from serving “capital” to serving productivity and the broader public interest.

A Look at the Numbers

A Look at the Numbers

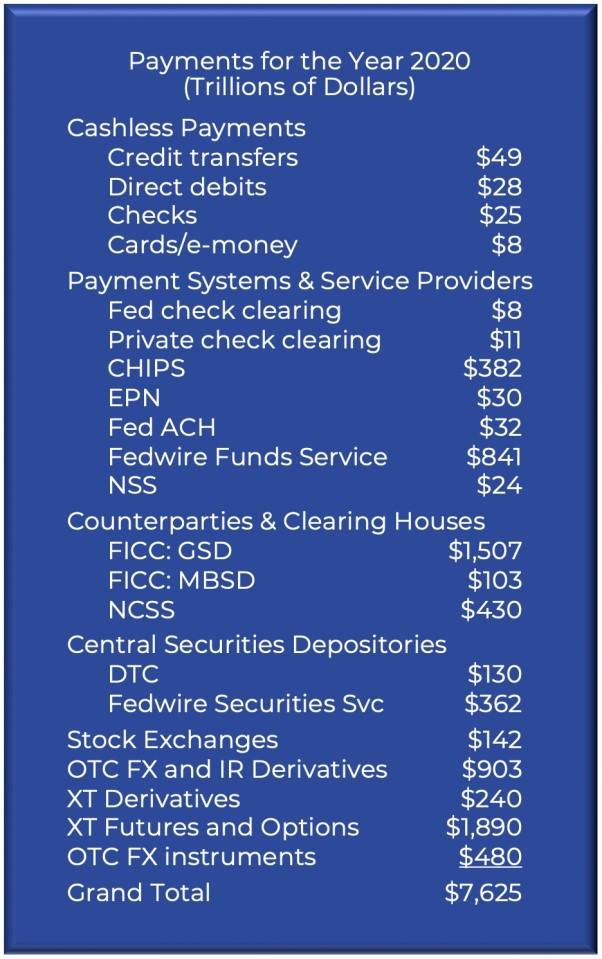

The material economy is roughly measured by the annual Gross Domestic Product (GDP), which for the U.S. had reached $25.6 trillion by the third quarter of 2022. (Michael Hudson observes that even GDP, as currently measured, is largely composed of non-productive financial services.) GDP is defined by spending, which depends on income. Collectively, Americans earned $21 trillion in 2021. The monetary economy is defined as the total amount of money that changes hands each year. Smith draws his figures from data that the Federal Reserve publishes annually in the Bank for International Settlements’ Red Book. The Red Book is not all-inclusive; it leaves out such payments as commodity trading, various options, crypto currency trades, and exchange-traded funds. But even its partial accounting shows $7.6 quadrillion in payments – more than 350 times our national collective income. Smith includes this chart[i]:

He comments:

Bridging the Wealth Gap

The financial transaction tax is not a new concept. The oldest tax still in existence was a stamp duty at the London Stock Exchange initiated in 1694. The tax was payable by the buyer of shares for the official stamp on the legal document needed to formalize the purchase. Many other countries have imposed FTTs, including the U.S. — some successfully and some not. In January 2021, U.S. Rep. Peter DeFazio reintroduced The Wall Street Tax Act, which was accompanied in March 2021 by a Senate bill introduced by Sen. Brian Schatz. According to a press release on the Schatz bill, the tax “would create a 0.1% tax on each sale of stocks, bonds, and derivatives, which will discourage unproductive trading and redirect investment toward more productive areas of the economy. The new tax would apply to the fair market value of equities and bonds, and the payment flows under derivatives contracts. Initial public offerings and short-term debt would be exempted.” Schatz stated:

"During the pandemic, Wall Street has cashed in on high-risk trades that add no real value to our economy and leave working families behind. We need to curb this dangerous trading to reduce volatility in the markets and encourage investment that can actually help our economy grow. By raising the price of financial transactions, we can make our financial system work better while bringing in billions in new revenue that we can reinvest in our workers and our communities."

Scott Smith concurs, noting that millions of people were forced into poverty during the first two years of the pandemic. In the same two years, the 10 richest men in the world doubled their fortunes and a new billionaire was minted every 26 hours. Much of this disparity was fueled by fiscal and monetary policy aimed at relieving the effects of the pandemic and of the 2008-09 banking crisis. Smith writes:

Our burgeoning monetary economy has fueled the rise of securitization, private equity, hedge funds, the foreign exchange market, commodity trading, cryptocurrency, digital assets, and investments in China. Quantitative easing further fanned these flames, driving up the price of financial assets. All such assets are monetary equivalents, and, thus, inflating the price of such assets balloons the money supply.

Most of these payments have little to do with what we regard as the real economy— the purchase of goods and services and the supply chain. Our GDP represents less than 0.33% of the payments in our economy. Once we see the big picture, the solution is obvious. We should tax payments instead of our income.

Smith calculates that U.S. spending by federal, state and local governments will total around $8.5 trillion in 2023. Dividing $7,625 trillion in payments by $8.5 trillion in government spending comes to a little more than 0.001, or a tenth of a percent (0.1%). Taxing payments at 0.1% could thus eliminate every tax we pay today, including social security (FICA) taxes, sales taxes, property taxes, capital gains taxes, estate taxes, gift taxes, excise taxes and customs taxes.

With a 0.25% FTT, “If you have a net worth of $20 million or less, you would come out ahead. And if you make $500 million per year, you will finally be paying your fair share of taxes – $1.25 million!”

With a 0.25% FTT, “If you have a net worth of $20 million or less, you would come out ahead. And if you make $500 million per year, you will finally be paying your fair share of taxes – $1.25 million!”

Bridging the Wealth Gap

The financial transaction tax is not a new concept. The oldest tax still in existence was a stamp duty at the London Stock Exchange initiated in 1694. The tax was payable by the buyer of shares for the official stamp on the legal document needed to formalize the purchase. Many other countries have imposed FTTs, including the U.S. — some successfully and some not. In January 2021, U.S. Rep. Peter DeFazio reintroduced The Wall Street Tax Act, which was accompanied in March 2021 by a Senate bill introduced by Sen. Brian Schatz. According to a press release on the Schatz bill, the tax “would create a 0.1% tax on each sale of stocks, bonds, and derivatives, which will discourage unproductive trading and redirect investment toward more productive areas of the economy. The new tax would apply to the fair market value of equities and bonds, and the payment flows under derivatives contracts. Initial public offerings and short-term debt would be exempted.” Schatz stated:

"During the pandemic, Wall Street has cashed in on high-risk trades that add no real value to our economy and leave working families behind. We need to curb this dangerous trading to reduce volatility in the markets and encourage investment that can actually help our economy grow. By raising the price of financial transactions, we can make our financial system work better while bringing in billions in new revenue that we can reinvest in our workers and our communities."

Scott Smith concurs, noting that millions of people were forced into poverty during the first two years of the pandemic. In the same two years, the 10 richest men in the world doubled their fortunes and a new billionaire was minted every 26 hours. Much of this disparity was fueled by fiscal and monetary policy aimed at relieving the effects of the pandemic and of the 2008-09 banking crisis. Smith writes:

Our burgeoning monetary economy has fueled the rise of securitization, private equity, hedge funds, the foreign exchange market, commodity trading, cryptocurrency, digital assets, and investments in China. Quantitative easing further fanned these flames, driving up the price of financial assets. All such assets are monetary equivalents, and, thus, inflating the price of such assets balloons the money supply.

What many lauded as a robust economy was really monetary inflation. This makes it more difficult for the next generation to start life. Monetary inflation moves a select few out of the middle class, making them newly rich, while relegating many more to being poorer.

… The trading of financial assets in the monetary economy represents the majority of the payments in the economy, eclipsing payments related to wages or the purchase of goods or services. Thus, it would be wealthy individuals and institutions, such as hedge funds, that would shoulder most of the burden of a payment tax.

Predictably, the Wall Street Tax Act has gotten pushback and has not gotten far. But Smith says his proposal is different. It is not adding a tax but is replacing existing taxes – with something that is actually better for most taxpayers. He has asked a number of hedge fund managers, day traders, private equity fund managers, and venture capital managers if a quarter-point tax would impact their businesses. They have shrugged it off as not significant, and have said that they would certainly prefer a payments tax to income taxes.

Predictably, the Wall Street Tax Act has gotten pushback and has not gotten far. But Smith says his proposal is different. It is not adding a tax but is replacing existing taxes – with something that is actually better for most taxpayers. He has asked a number of hedge fund managers, day traders, private equity fund managers, and venture capital managers if a quarter-point tax would impact their businesses. They have shrugged it off as not significant, and have said that they would certainly prefer a payments tax to income taxes.

Responding to the Critics: The Sweden Debacle

Among failed FTT attempts, one often cited by critics was undertaken in Sweden in the 1980s. As reported by the Securities Industry and Financial Markets Association (SIFMA):

There were negative capital markets impacts seen in the great migration of trading volumes across multiple products to London, equity index returns fell, volatility increased and the interest rate options markets essentially disappeared.

But as argued by James Li in a podcast titled “The Truth About a Financial Transaction Tax“:

Sweden’s tax policy … had an obvious, massive loophole, which is that Swedish traders could migrate to the London Stock Exchange to avoid the tax — which they did, until it was eventually abolished. On the other hand, the UK’s financial transaction tax has been much more successful. In 1694, King William III levied a stamp duty on all paper transactions, and a version of that levy still exists today, taxing many stock trades at 0.5 percent. Unlike the defunct Swedish tax, it applies to trades of shares of any UK company, regardless of where traders are based.

Among failed FTT attempts, one often cited by critics was undertaken in Sweden in the 1980s. As reported by the Securities Industry and Financial Markets Association (SIFMA):

There were negative capital markets impacts seen in the great migration of trading volumes across multiple products to London, equity index returns fell, volatility increased and the interest rate options markets essentially disappeared.

But as argued by James Li in a podcast titled “The Truth About a Financial Transaction Tax“:

Sweden’s tax policy … had an obvious, massive loophole, which is that Swedish traders could migrate to the London Stock Exchange to avoid the tax — which they did, until it was eventually abolished. On the other hand, the UK’s financial transaction tax has been much more successful. In 1694, King William III levied a stamp duty on all paper transactions, and a version of that levy still exists today, taxing many stock trades at 0.5 percent. Unlike the defunct Swedish tax, it applies to trades of shares of any UK company, regardless of where traders are based.

Again, Smith argues that the challenges met by other transaction tax proposals have arisen because they were being proposed as an additional tax. A payment tax in lieu of personal and corporate income taxes takes on a whole different character. He argues that big firms, rather than moving offshore to avoid a payments tax, would move to the U.S., since the tax rate in other nations would be much higher. Without a corporate or income tax, the U.S. would be the most favored tax haven in the world.

He adds that an exit tax could be a good idea: any money leaving the U.S. could be taxed at a 5% rate. That would discourage people from wiring money to an offshore exchange. But incoming money would not be taxed, encouraging foreign money to come to the U.S. to stay long-term, where it would be taxed less than elsewhere.

The Alleged Threat to Retirees

The Alleged Threat to Retirees

for Main Street investors. He cites a report from the Modern Markets Initiative on the effects of the tax on savings and retirement security. A Business Wire headline on the report warns, “Latest Data from Modern Markets Initiative Shows the Financial Transaction Tax Would Threaten the Retirement Savings of Millions of Americans.” Among other claims is that a financial transactions tax would cost “$45,000 to $65,000 in FTT over the lifetime of a 401(k) account, or the equivalent of delaying the average individual’s retirement by approximately two years.” How that calculation was made is not included in the article, which refers the reader to the report. Li looked it up, and says on his podcast that it was highly misleading:

[T]he study stated that under this type of tax, for every $100,000 of assets in a 401(k) plan, the saver would owe $281 dollars in FTT taxes in a given year; and then over a 40-year time horizon paying in at $281 a year at 7% annual growth – the average for pension funds – that this would yield a total value of $64,232 after 40 years.

… [What they were] actually saying is, “If you put $100,000 a year into your 401(k), you would be paying approximately $281 in taxes for that $100,000; and if you had instead invested that money every year in a fund with 7% interest, that amount would add up to about $64,000 after 40 years.”

… I don’t know about you, but I can’t put $100,000 in my 401(k) plan every year. Very few people can. A more accurate estimate on how this would actually impact the average retirement savings is to look at the median income, which is around $52,000 a year, with an estimated $5,000 contribution into a 401(k) annually, which is around 10% of your gross pay based on commonly accepted financial planning advice. So the average person would only pay about $13 in FTT taxes in a given year.

These people are extremely tricky and their logic is also extremely flawed, because we pay taxes all the time. It’s like saying, “Oh, if I didn’t have to pay an income tax, I would be able to put all that money away and be up like a million bucks when I retire.”

Similar arguments are made concerning potential losses from FTTs to pension funds and the stock market. SIFMA contends, “What’s bad for the capital markets is bad for the economy,” stating “The capital markets fund 65% of economic activity in the U.S.” Perhaps, but the money paid for shares of stock traded in the stock market does not go to the corporations issuing the stock. It goes to the previous shareholders. Only the sale of IPOs – initial public offerings – generates money for the corporation, and this money is typically exempted from FTTs. Trades after that are simply gambling, hoping to sell at a higher price to the “greater fool.”

Killing the Parasite That Is Killing the Host

Killing the Parasite That Is Killing the Host

In the 2015 book Killing the Host – How Financial Parasites and Debt Destroy the Global Economy, Michael Hudson calls “finance capitalism” a parasite that is consuming the fruits of “industrial capitalism” – the goods and services traded in what Smith calls the material economy. Pam Martens writes in a review of Hudson’s book that this “blood-sucking financial leech [is] affixed to your body, your retirement plan, and your economic future.”

But it is not actually the pension funds that are doing most of the financialized trades or that would get taxed on those trades. It is their asset managers – including BlackRock and Vanguard, both of which lost money overall in 2022. If the asset managers can’t make money in the financialized economy, perhaps it would be better for the pension funds to move to more productive investments – from “finance capitalism” to “industrial capitalism.”

Publicly-owned banks mandated to serve the public interest would be good options if we had them. As the economy falters, the public banking movement is picking up steam, part of a much-needed shift towards an economy that puts the public interest above private profits.

_____________________________

_____________________________

This article was first posted on ScheerPost. Ellen Brown is an attorney, chair of the Public Banking Institute, and author of thirteen books including Web of Debt, The Public Bank Solution, and Banking on the People: Democratizing Money in the Digital Age. She also co-hosts a radio program on PRN.FM called “It’s Our Money.” Her 400+ blog articles are posted at EllenBrown.com.