POSITIVE MONEY

INTEREST-FREE MONEY

by Rafael Zambrana Nov 6, 2014.

by Rafael Zambrana Nov 6, 2014.

Recent Articles

Courtesy of the Venus Project

INTEREST-FREE

MONEY

MONEY

Minority rules:

Scientists discover tipping point for the spread of ideas

Scientists at Rensselaer Polytechnic Institute have found that when just 10 percent of the population holds an unshakable belief, their belief will always be adopted by the majority of the society. The scientists, who are members of the Social Cognitive Networks Academic Research Center (SCNARC) at Rensselaer, used computational and analytical methods to discover the tipping point where a minority belief becomes the majority opinion. The finding has implications for the study and influence of societal interactions ranging from the spread of innovations to the movement of political ideals.

CLICK HERE for more

What this means is we only need 10% of the population to understand how these few individuals are robbing us and enslaving us to transform the narrative society believes in, to stop them.

Scientists discover tipping point for the spread of ideas

Scientists at Rensselaer Polytechnic Institute have found that when just 10 percent of the population holds an unshakable belief, their belief will always be adopted by the majority of the society. The scientists, who are members of the Social Cognitive Networks Academic Research Center (SCNARC) at Rensselaer, used computational and analytical methods to discover the tipping point where a minority belief becomes the majority opinion. The finding has implications for the study and influence of societal interactions ranging from the spread of innovations to the movement of political ideals.

CLICK HERE for more

What this means is we only need 10% of the population to understand how these few individuals are robbing us and enslaving us to transform the narrative society believes in, to stop them.

One way of solving this dilemma of charging no interest, is to have a community fund where all profits are accumulated and make it available to every single entrepreneur. For this to work we could institute that in every new enterprise, the community would be a silent partner in the venture, allowing the entrepreneur to have total freedom to conduct the project with an extra benefit of sharing the risks with the community.

There would be limits in how much the entrepreneur could keep for him or herself, but NO TAXES are necessary since the community is accumulating profits in the Community Fund from being a silent partner, and using these funds to construct all the infrastructure for the project (which already happens to attract corporations like Walmart to establish in a county, for example, but all the benefits go to Walmart investors, not the community) without having to charge any taxes.

A Guaranteed Income would be established for everyone, using "sovereign money" (that is, NO Debt-Based currency) that will allow for the economy to function even if everyone is free of debt (which today is not possible using this debt-based money) attaining full employment and an implied responsibility for every one in society receiving the Guaranteed Income, is to be available to work in their line of interest and willing to train to accommodate the needs of the community. Working hours will be reduced according to the robotics introduced to work more efficiently. The question of freedom can be answered by having a parallel system where people don't have to follow these rules, but will lose their guaranteed income for the "freedom" to struggle for a job they prefer. (more options probably exist once more people join the debate)

COMMENTARY

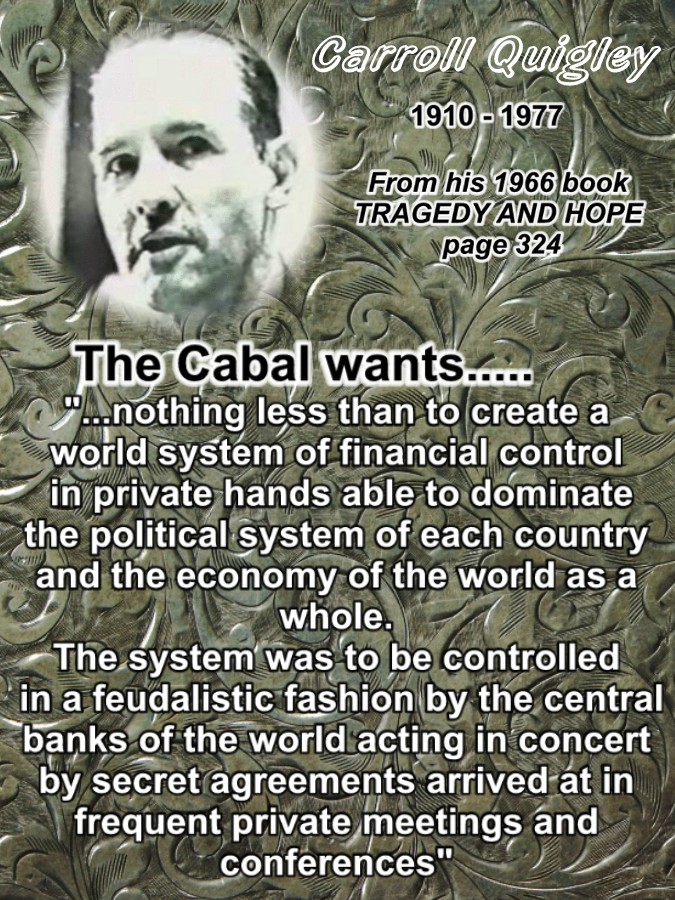

It is "socially acceptable" today for people to expect to live from interest in the capital they have accumulated in their working lives because this idea benefits the owners of their lives, the bankers. Bankers want others to "defend" the ideas they are imposing on others that benefit them royally, by making them accomplices, even if those "soldiers" are making a fraction of what the bankers are getting away with.

Today's interest rates are so low, it's an insult to savers while banksters borrow at nothing from the FED to play the Casino Derivatives market.

I have seen many people defending ideas that are actually forcing them to give up on the fruits of their efforts and allow others to steal from them, because they believe they will do the same in the future, they expect their fortunes will change and then will be in a position of benefiting just like the bankers do by doing this criminally insane system, on others. These people should be marginalized to move on to societies that allow that behavior in other parts of the world and hope they will evolve to understand the new paradigm.

One thing very critical to understand is what is capital? How is it being formed?

Real Capital comes from the production of consumer goods necessary for society to live practically, ONLY. It comes from Real Profits as a surplus to the prices paid by those who use the products and services. It is the result of a transaction that involves the lives of real people benefiting of the services or products purchased, solving a real need to live.

FALSE PROFITS are all of those that are the result of FINANCIAL SPECULATION, that today are openly accepted because our "owners", the bankers, are the main beneficiaries of them. When someone buys currency at one price but sells it at a higher price, the transaction has not produced absolutely nothing new that benefits any one with a new product or service, and is the result of speculation, therefore it is a FALSE PROFIT. In a society that recognizes and promotes REAL benefit for all its members, will discourage this sort of activities that only fools see any value in it.

A lot more needs to be addressed in this issue and hope others have their own ideas.

There would be limits in how much the entrepreneur could keep for him or herself, but NO TAXES are necessary since the community is accumulating profits in the Community Fund from being a silent partner, and using these funds to construct all the infrastructure for the project (which already happens to attract corporations like Walmart to establish in a county, for example, but all the benefits go to Walmart investors, not the community) without having to charge any taxes.

A Guaranteed Income would be established for everyone, using "sovereign money" (that is, NO Debt-Based currency) that will allow for the economy to function even if everyone is free of debt (which today is not possible using this debt-based money) attaining full employment and an implied responsibility for every one in society receiving the Guaranteed Income, is to be available to work in their line of interest and willing to train to accommodate the needs of the community. Working hours will be reduced according to the robotics introduced to work more efficiently. The question of freedom can be answered by having a parallel system where people don't have to follow these rules, but will lose their guaranteed income for the "freedom" to struggle for a job they prefer. (more options probably exist once more people join the debate)

COMMENTARY

It is "socially acceptable" today for people to expect to live from interest in the capital they have accumulated in their working lives because this idea benefits the owners of their lives, the bankers. Bankers want others to "defend" the ideas they are imposing on others that benefit them royally, by making them accomplices, even if those "soldiers" are making a fraction of what the bankers are getting away with.

Today's interest rates are so low, it's an insult to savers while banksters borrow at nothing from the FED to play the Casino Derivatives market.

I have seen many people defending ideas that are actually forcing them to give up on the fruits of their efforts and allow others to steal from them, because they believe they will do the same in the future, they expect their fortunes will change and then will be in a position of benefiting just like the bankers do by doing this criminally insane system, on others. These people should be marginalized to move on to societies that allow that behavior in other parts of the world and hope they will evolve to understand the new paradigm.

One thing very critical to understand is what is capital? How is it being formed?

Real Capital comes from the production of consumer goods necessary for society to live practically, ONLY. It comes from Real Profits as a surplus to the prices paid by those who use the products and services. It is the result of a transaction that involves the lives of real people benefiting of the services or products purchased, solving a real need to live.

FALSE PROFITS are all of those that are the result of FINANCIAL SPECULATION, that today are openly accepted because our "owners", the bankers, are the main beneficiaries of them. When someone buys currency at one price but sells it at a higher price, the transaction has not produced absolutely nothing new that benefits any one with a new product or service, and is the result of speculation, therefore it is a FALSE PROFIT. In a society that recognizes and promotes REAL benefit for all its members, will discourage this sort of activities that only fools see any value in it.

A lot more needs to be addressed in this issue and hope others have their own ideas.

CLICK ON IMAGE TO WATCH FILM

CLICK ON IMAGE TO WATCH FILM

Interest-Free Money - A Book-List

The following is a collection that examines the history and effects of charging interest on lent money. I’d be glad to receive suggested additions that explain, not the ills of the present economic system, but which cover specific discussions of usury and descriptions for its replacement.

Networking for The Campaign for Interest-Free Money

***********************************************************

Margrit Kennedy ‘'Interest and Inflation-Free Money’

New Society Publishers, Philadelphia, USA, 1995

(USA ISBN 0-86571-319-7)

A good - almost unique book - explaining the effects of interest on daily life and the way it stops civilised life developing.

**********************************************************

James Buchan ‘Frozen Desire: An Inquiry into the Meaning of Money’

Picador, London, 1997

ISBN 0-330-36931-8 (paperback)

A lyrical book, written by a novelist and journalist, that examines the history of money and our relationship with it. Widely available.

**********************************************************

Dorothy Rowe ‘The Real Meaning of Money’

Harper Collins, London, 1997

ISBN 0-025-5329-5 (Also now available in paperback)

An extensive examination of the interaction of individuals and money, written by a well-known and widely-published psychologist.

**********************************************************

Peter Selby ‘Grace and Mortgage:

The Language of Faith and the Debt of the World’

Darton, Longman and Todd, London, 1997

ISBN 0-232-521700 (Paperback)

Written by the Anglican Bishop of Worcester, this marks an important step in the Established Church’s rediscovery of "ancient wisdoms."

**********************************************************

Sir Harry Page ‘In Restraint of Usury: The Lending of Money at Interest’

Chartered Institute for Public Finances and Accounts (CIPFA),

London, 1985. ISBN 0-85299-2858

Written by a former President of CIPFA and past Treasurer of the City of Manchester, this small book tells what most other historians leave out - the first legalisation of usury by Henry VIII in 1545. Sadly now out of print, this points out the disastrous effect that usury has on providing quality public services and the resulting misery caused.

**********************************************************

Christopher Hill ‘Reformation To Industrial Revolution’

Pelican Economic History, Volume 2: 1530-1780

Penguin, London, 1969.

Although this misses Henry’s Act of 1545, it is a first-rate account of the struggles between Westminster and the City of London: particularly valuable is Chapter 6 ‘The Financial Revolution.’

**********************************************************

Bertrand Russell ‘A History of Western Philosophy’

Allen and Unwin, London, 1946

Passes the ‘U-test’ - contains an excellent and concise examination of usury (via the index.)

***********************************************************Chris Harman ‘Economics of The Madhouse: Capitalism and the Market Today’

Bookmarks, London, 1995

ISBN 1-898876-03-7 (Paperback)

Good, short, readable account of Marx’ insights into the way usury-driven economics (capitalism!) works - easily recognisable to any who have been in business.)

***********************************************************

Gary Allen ‘None Dare Call It Conspiracy’

Concord Books, Seal Beach, California, 1971

(Also Britons Publishing Co, 1973)

Some-times hair-raising account of the relationships between the banking communities across the globe: the material here has been examined by G William Dommen ‘Who Runs America Now’ Touchstone Books.

***********************************************************

Peter Lang ‘LETS Work: Rebuilding The Local Economy’

Grover Books, Bristol, England BS6 5QA

ISBN 1 899233 00 8

Fine account of locally-created interest-free money. Wonderful quote from Alan Watts (Chapter 1: Money: what it is and how it lets us down)

"The Absurdity of It: . . . To say that people cannot exchange value with one another because there is no money is like saying you cannot build a house because you have no feet and inches."

(To which I might add, that paying interest on lent money is as ludicrous as the builder paying the feet and inches a wage, once the house is built!)

***********************************************************

Also Michael Rowbotham's 'The Grip of Death' and 'Goodbye America' both published by Jon Carpenter, 1999 and 2000, are good on Fractional Reserve Banking

************************************************************

The following is a collection that examines the history and effects of charging interest on lent money. I’d be glad to receive suggested additions that explain, not the ills of the present economic system, but which cover specific discussions of usury and descriptions for its replacement.

Networking for The Campaign for Interest-Free Money

***********************************************************

Margrit Kennedy ‘'Interest and Inflation-Free Money’

New Society Publishers, Philadelphia, USA, 1995

(USA ISBN 0-86571-319-7)

A good - almost unique book - explaining the effects of interest on daily life and the way it stops civilised life developing.

**********************************************************

James Buchan ‘Frozen Desire: An Inquiry into the Meaning of Money’

Picador, London, 1997

ISBN 0-330-36931-8 (paperback)

A lyrical book, written by a novelist and journalist, that examines the history of money and our relationship with it. Widely available.

**********************************************************

Dorothy Rowe ‘The Real Meaning of Money’

Harper Collins, London, 1997

ISBN 0-025-5329-5 (Also now available in paperback)

An extensive examination of the interaction of individuals and money, written by a well-known and widely-published psychologist.

**********************************************************

Peter Selby ‘Grace and Mortgage:

The Language of Faith and the Debt of the World’

Darton, Longman and Todd, London, 1997

ISBN 0-232-521700 (Paperback)

Written by the Anglican Bishop of Worcester, this marks an important step in the Established Church’s rediscovery of "ancient wisdoms."

**********************************************************

Sir Harry Page ‘In Restraint of Usury: The Lending of Money at Interest’

Chartered Institute for Public Finances and Accounts (CIPFA),

London, 1985. ISBN 0-85299-2858

Written by a former President of CIPFA and past Treasurer of the City of Manchester, this small book tells what most other historians leave out - the first legalisation of usury by Henry VIII in 1545. Sadly now out of print, this points out the disastrous effect that usury has on providing quality public services and the resulting misery caused.

**********************************************************

Christopher Hill ‘Reformation To Industrial Revolution’

Pelican Economic History, Volume 2: 1530-1780

Penguin, London, 1969.

Although this misses Henry’s Act of 1545, it is a first-rate account of the struggles between Westminster and the City of London: particularly valuable is Chapter 6 ‘The Financial Revolution.’

**********************************************************

Bertrand Russell ‘A History of Western Philosophy’

Allen and Unwin, London, 1946

Passes the ‘U-test’ - contains an excellent and concise examination of usury (via the index.)

***********************************************************Chris Harman ‘Economics of The Madhouse: Capitalism and the Market Today’

Bookmarks, London, 1995

ISBN 1-898876-03-7 (Paperback)

Good, short, readable account of Marx’ insights into the way usury-driven economics (capitalism!) works - easily recognisable to any who have been in business.)

***********************************************************

Gary Allen ‘None Dare Call It Conspiracy’

Concord Books, Seal Beach, California, 1971

(Also Britons Publishing Co, 1973)

Some-times hair-raising account of the relationships between the banking communities across the globe: the material here has been examined by G William Dommen ‘Who Runs America Now’ Touchstone Books.

***********************************************************

Peter Lang ‘LETS Work: Rebuilding The Local Economy’

Grover Books, Bristol, England BS6 5QA

ISBN 1 899233 00 8

Fine account of locally-created interest-free money. Wonderful quote from Alan Watts (Chapter 1: Money: what it is and how it lets us down)

"The Absurdity of It: . . . To say that people cannot exchange value with one another because there is no money is like saying you cannot build a house because you have no feet and inches."

(To which I might add, that paying interest on lent money is as ludicrous as the builder paying the feet and inches a wage, once the house is built!)

***********************************************************

Also Michael Rowbotham's 'The Grip of Death' and 'Goodbye America' both published by Jon Carpenter, 1999 and 2000, are good on Fractional Reserve Banking

************************************************************

TODAY MONEY IS CREATED OUT OF NOTHING, AND BANKS CHARGE US INTEREST

What has to be taken into account is that today the economy already produces a much larger amount of wealth than it appears, because there is a huge amount of "leakage" or fraud inflicted on the productive sector of the economy by the financial side, living like kings well beyond their actual generation of wealth on the backs of hard working people struggling in "The Real Economy", the productive side that in fact generates the wealth of society.

It is no wonder it is China that has about 4 trillion in its reserves, because they DO produce what people of the world consume for living, while the USA and Europe have debts.

Britain and the US get their "profits" from false financial speculation.

It is no wonder it is China that has about 4 trillion in its reserves, because they DO produce what people of the world consume for living, while the USA and Europe have debts.

Britain and the US get their "profits" from false financial speculation.

Debunking Money Damon Bravel - 1 Myth and Machiavelli