POSITIVE MONEY

CHINA teaches a lesson in

trusting the Markets

by Rafael Zambrana Oct. 20 2014

trusting the Markets

by Rafael Zambrana Oct. 20 2014

Recent Articles

Courtesy of the Venus Project

CHINA Teaches a Lesson in trusting the Markets

Minority rules:

Scientists discover tipping point for the spread of ideas

Scientists at Rensselaer Polytechnic Institute have found that when just 10 percent of the population holds an unshakable belief, their belief will always be adopted by the majority of the society. The scientists, who are members of the Social Cognitive Networks Academic Research Center (SCNARC) at Rensselaer, used computational and analytical methods to discover the tipping point where a minority belief becomes the majority opinion. The finding has implications for the study and influence of societal interactions ranging from the spread of innovations to the movement of political ideals.

CLICK HERE for more

What this means is we only need 10% of the population to understand how these few individuals are robbing us and enslaving us to transform the narrative society believes in, to stop them.

Scientists discover tipping point for the spread of ideas

Scientists at Rensselaer Polytechnic Institute have found that when just 10 percent of the population holds an unshakable belief, their belief will always be adopted by the majority of the society. The scientists, who are members of the Social Cognitive Networks Academic Research Center (SCNARC) at Rensselaer, used computational and analytical methods to discover the tipping point where a minority belief becomes the majority opinion. The finding has implications for the study and influence of societal interactions ranging from the spread of innovations to the movement of political ideals.

CLICK HERE for more

What this means is we only need 10% of the population to understand how these few individuals are robbing us and enslaving us to transform the narrative society believes in, to stop them.

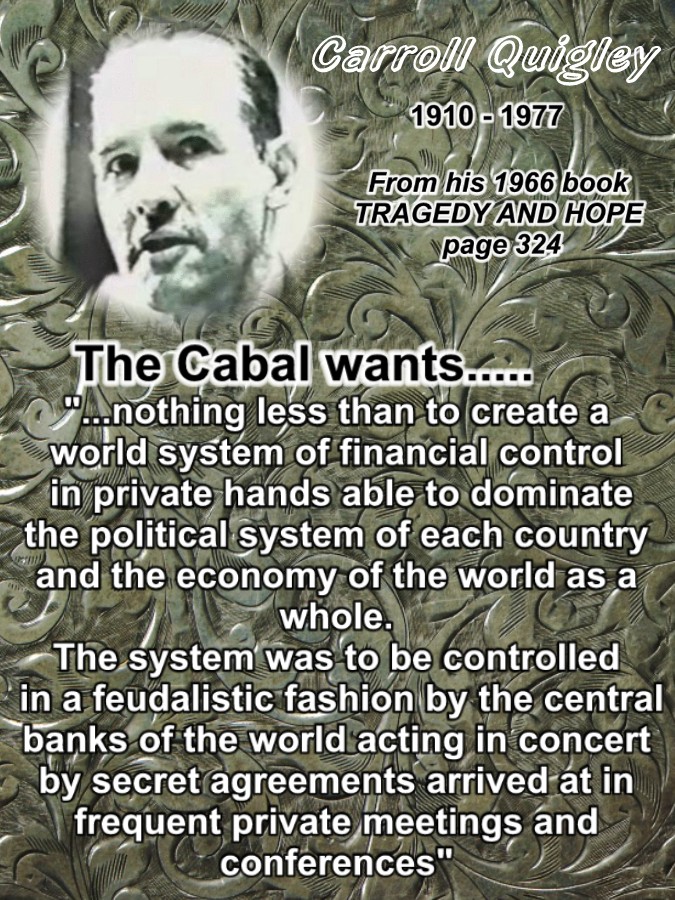

Study shows a mere few hundred individuals control 80% of the assets in the world

WEAR YOUR MIND AT

ETNIKS.COM

ETNIKS.COM

I think it's amusing how the main assumption in most people, from the interviewer and many others in the western corporate Main Stream Media, is to render China as vulnerable as the US in the case of the pop up of their Real Estate bubble, as if it was the same system as in the US where most people purchase a home with a mortgage.

Chinese and Orientals in general, even in the US tend to buy CASH, and therefore the "crash" will pressure them much less than if they owed the money to a bank.

Another important element in this equation is the fact ALL BANKS IN CHINA ARE PUBLIC and they are forbidden to speculate in the derivatives market. If the Chinese government has so much leverage over their economy, as is the case here, then obviously results will be very different to what they have been in the West.

The great irony is to see the Chinese to be allowing THE MARKET to correct itself in a more proper fashion, than the West has shown is ready to do.

If the "Too Big to Fail" banks in the world had been allowed to collapse and then SOCIETY in the way of governments had been allowed to TAKE OVER those banks and sack all their CEO's and management, clean their portfolios selling the bad assets at whatever the market would pay, and keep the good ones and RE-SELL THE BANKS to the best bidder...... we would have followed the USUAL capitalist tradition instead of corrupt politicians to have CAVED IN to the HOLLOW financial power of a FEW BANKSTERS.

When the Chinese talk about the "market" correct the glut, they mean those apartments will have to be sold at whatever low prices will attract buyers, crushing many of the developers, but making available many good apartments to a lot of new buyers who will end up with a good home at a reasonable price. Since the banks who "lost" because the developers couldn't pay them back, are actually owned by the people of China, it is a subsidize housing on the backs of GREEDY developers who will pass to history as very stupid and teach a lesson to others who better learn from this in the future.

In contrast in the West, governments actually gave a totally different lesson to those idiots who created the global debt crisis, by "bailing them out" and in fact Prizing them for their stupidity!!!

This is why the end of the long WESTERN top position is being lost to the EAST where people have learned the lessons they have taken from the West BETTER than the West seems to have learned them.

What we need to do is to at least let STATES TO HAVE THEIR OWN PUBLIC BANKS, as the North Dakota good example offers, and stop all greed and speculation in its tracks. End the BS of derivatives that are a CANCER for societies everywhere.

China is creating a new model of development, we here better pay attention to.

Chinese and Orientals in general, even in the US tend to buy CASH, and therefore the "crash" will pressure them much less than if they owed the money to a bank.

Another important element in this equation is the fact ALL BANKS IN CHINA ARE PUBLIC and they are forbidden to speculate in the derivatives market. If the Chinese government has so much leverage over their economy, as is the case here, then obviously results will be very different to what they have been in the West.

The great irony is to see the Chinese to be allowing THE MARKET to correct itself in a more proper fashion, than the West has shown is ready to do.

If the "Too Big to Fail" banks in the world had been allowed to collapse and then SOCIETY in the way of governments had been allowed to TAKE OVER those banks and sack all their CEO's and management, clean their portfolios selling the bad assets at whatever the market would pay, and keep the good ones and RE-SELL THE BANKS to the best bidder...... we would have followed the USUAL capitalist tradition instead of corrupt politicians to have CAVED IN to the HOLLOW financial power of a FEW BANKSTERS.

When the Chinese talk about the "market" correct the glut, they mean those apartments will have to be sold at whatever low prices will attract buyers, crushing many of the developers, but making available many good apartments to a lot of new buyers who will end up with a good home at a reasonable price. Since the banks who "lost" because the developers couldn't pay them back, are actually owned by the people of China, it is a subsidize housing on the backs of GREEDY developers who will pass to history as very stupid and teach a lesson to others who better learn from this in the future.

In contrast in the West, governments actually gave a totally different lesson to those idiots who created the global debt crisis, by "bailing them out" and in fact Prizing them for their stupidity!!!

This is why the end of the long WESTERN top position is being lost to the EAST where people have learned the lessons they have taken from the West BETTER than the West seems to have learned them.

What we need to do is to at least let STATES TO HAVE THEIR OWN PUBLIC BANKS, as the North Dakota good example offers, and stop all greed and speculation in its tracks. End the BS of derivatives that are a CANCER for societies everywhere.

China is creating a new model of development, we here better pay attention to.

CLICK ON IMAGE TO WATCH FILM

CLICK ON IMAGE TO WATCH FILM